Understand ALL Your Options

Medicare 101

Original Medicare

Original Medicare is a federally administered health insurance program in the United States, primarily designed for individuals aged 65 and older, as well as for younger people with qualifying disabilities. It provides essential health coverage and is divided into two main parts, each tailored to cover different aspects of healthcare needs.

Medicare Part A: Hospital Insurance

What It Covers:

- Hospital Stays: Includes coverage for semi-private rooms, meals, and general nursing care during hospital stays.

- Skilled Nursing Facility Care: Provides coverage for services in a skilled nursing facility following a hospital stay for a related illness or injury.

- Hospice Care: Offers compassionate care for terminally ill patients, including pain relief and symptom management.

- Home Health Services: Covers limited home health care services if certain conditions are met, focusing on recovery and rehabilitation.

Medicare Part B: Medical Insurance

What It Covers:

- Doctor Visits: Covers medically necessary doctor services, including outpatient care and some preventive services.

- Preventive Services: Includes screenings, vaccinations, and diagnostic tests intended to prevent or detect illnesses early.

- Durable Medical Equipment (DME): Provides coverage for medical equipment like wheelchairs and walkers that are prescribed for use at home.

Coverage Gaps

Original Medicare, which consists of Part A (hospital insurance) and Part B (medical insurance), provides substantial healthcare coverage but has several notable coverage gaps that beneficiaries need to manage. Here’s a detailed breakdown of these gaps:

- Prescription Drug Coverage: Original Medicare does not include coverage for most prescription drugs, which is a significant gap for many beneficiaries. Those needing medication typically must enroll in Medicare Part D, a standalone plan, or choose a Medicare Advantage plan that includes drug coverage.

- Routine Dental, Vision, and Hearing Care: These essential services are not covered under Original Medicare. This includes everything from routine eye exams and eyeglasses to dental checkups and hearing aids. Beneficiaries often need to purchase separate insurance policies or join a Medicare Advantage plan that offers these benefits.

- Long-Term Care: Original Medicare does not cover long-term care services, which can include custodial care for individuals who need assistance with daily activities like bathing, dressing, and other routine tasks.

- Out-of-Pocket Costs:

- Part A Costs: Beneficiaries face a deductible for each benefit period in hospital settings, along with daily copayments for extended stays in hospitals and skilled nursing facilities after the initial coverage period.

- Part B Costs: There is an annual deductible for services under Part B, after which Medicare covers 80% of the approved services, leaving the beneficiary to pay the remaining 20% as coinsurance. This can be significant for high-cost services such as chemotherapy or surgery.

- Overseas Medical Coverage: Original Medicare offers very limited coverage for healthcare services outside the United States, which can be a concern for those who travel frequently.

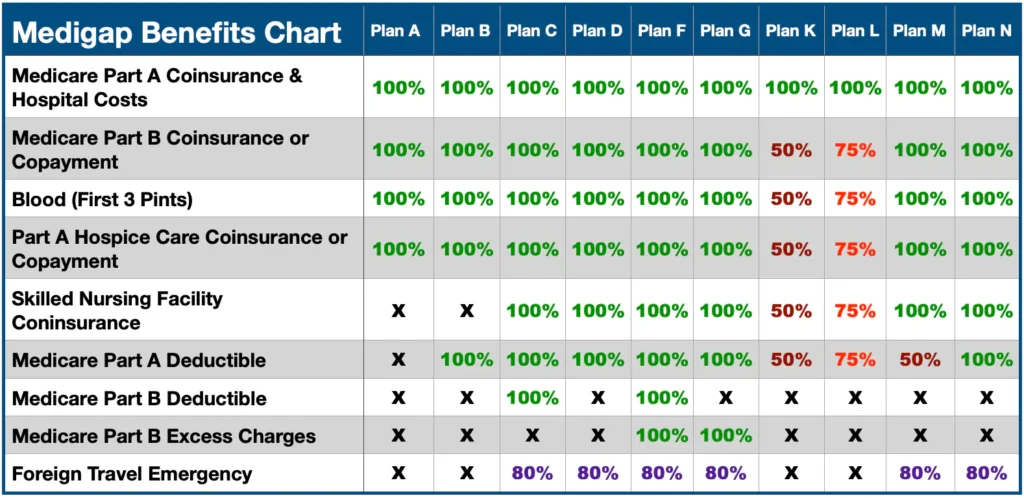

Medicare Supplements

Medicare Supplement Plans (Medigap) provide essential coverage to complement your Original Medicare (Part A and Part B) benefits. These private health insurance policies are crucial for covering out-of-pocket expenses such as copayments, coinsurance, and deductibles that are not fully covered by Medicare. Offered by private insurance companies, Medigap plans are standardized, ensuring consistent coverage across different insurers. Beneficiaries can choose from a variety of plan options, including the popular Medicare Plan G, to best meet their healthcare needs, ensuring more predictable healthcare costs and the freedom to choose any healthcare provider that accepts Medicare.

It’s important for beneficiaries to understand that while Medigap plans enhance Original Medicare coverage, they do not include prescription drug coverage. To cover medications, beneficiaries should consider enrolling in a separate Medicare Part D plan. This approach ensures comprehensive healthcare coverage, managing both medical and prescription drug costs effectively.

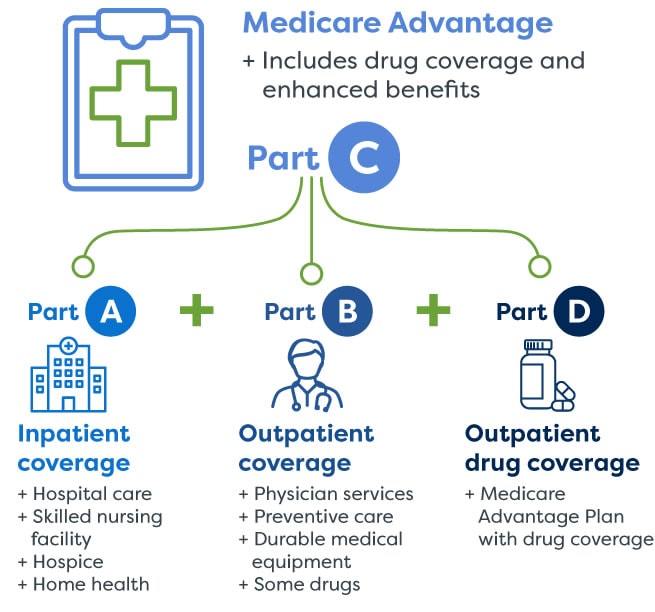

Medicare Advantage

Medicare Advantage Plans (Medicare Part C) provide a comprehensive alternative to Original Medicare (Part A and Part B), offered through private insurance companies. These all-in-one plans not only encompass hospital and medical coverage but often extend to include additional benefits such as prescription drug coverage, vision, dental, and hearing services. Medicare Advantage plans typically operate within a specific network of healthcare providers and may feature different rules and costs compared to Original Medicare.

Opting for a Medicare Advantage plan can simplify the management of healthcare needs by consolidating various types of coverage into a single plan. These plans are popular for their potential cost savings and additional benefits. However, it’s crucial for beneficiaries to thoroughly assess each plan’s details, including provider networks and out-of-pocket costs, to ensure that it aligns with their unique healthcare needs.

Medicare Part D is a prescription drug coverage program offered by private insurance companies approved by Medicare. It is designed to help beneficiaries pay for their prescription medications. Part D plans can be obtained as standalone plans, or they can be included in some Medicare Advantage plans. These plans have a list of covered medications called a formulary, which includes generic and brand-name drugs. Beneficiaries typically pay a monthly premium, an annual deductible (if applicable), and copayments or coinsurance for their medications. Part D provides essential financial assistance for prescription drugs, ensuring that Medicare beneficiaries have access to the medications they need to maintain their health and well-being.

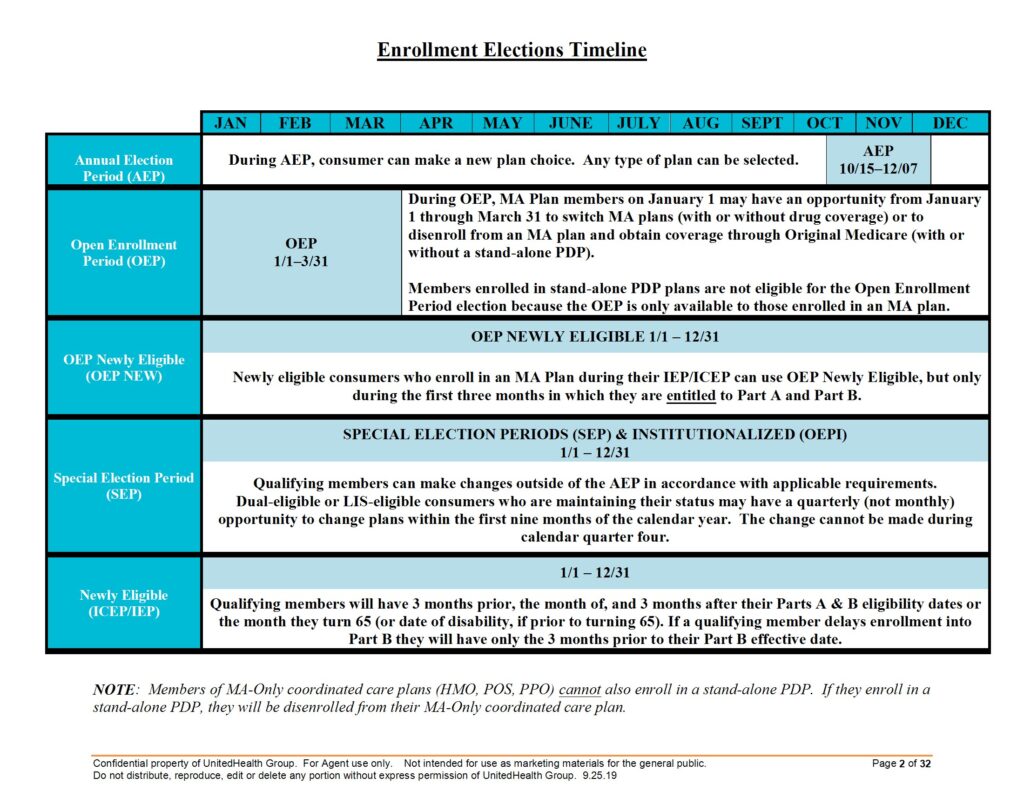

When to Enroll?

Enrolling in Medicare during the correct Enrollment Period is crucial for avoiding late enrollment penalties. The Initial Enrollment Period (IEP) traditionally begins three months before your 65th birthday, encompasses the birth month, and extends for three months afterward, offering a seven-month window to sign up for Medicare. This timing is critical to ensure you receive Medicare coverage timely and without extra costs.

Individuals already receiving Social Security or Railroad Retirement Board (RRB) benefits are automatically enrolled in Medicare Parts A and B upon turning 65. For those not receiving these benefits, it’s essential to proactively sign up during the IEP to secure health coverage as soon as eligibility begins. Failing to enroll within this period can lead to permanent penalties and gaps in healthcare coverage, so it’s important to be aware of and prepare for this crucial enrollment window.

Contact

Office: (847)860-6191

[email protected]

Location

Based in Chicago, Illinois

Licensed in AL, AZ, CO, Fl, IA, IL, IN, KS, MI, MO, NM, OH, TX